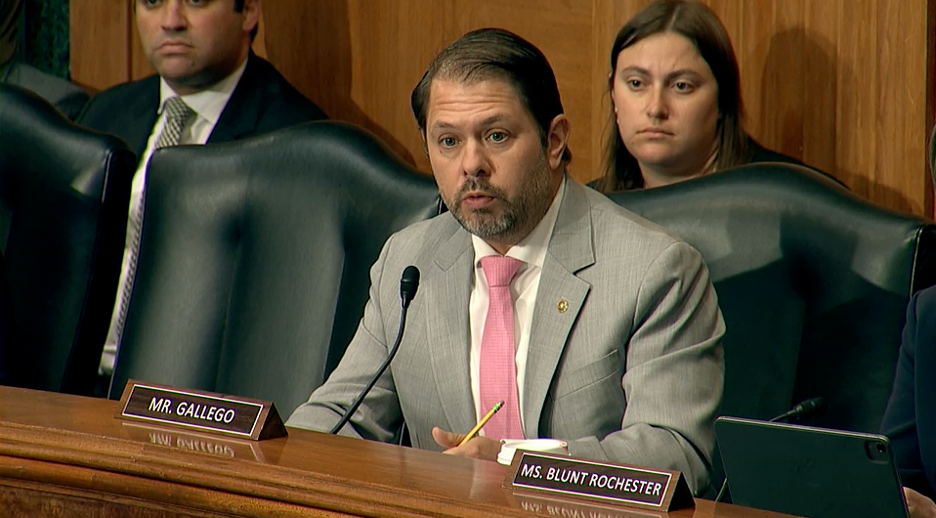

WASHINGTON – Today, during a Senate Banking, Housing, and Urban Affairs Committee Hearing, Senator Ruben Gallego (D-AZ) questioned Federal Reserve Board of Governors nominee Stephen Miran about his commitment to preserving the independent, nonpolitical role of the Federal Reserve.

Watch Senator Gallego’s questioning HERE.

During his questioning, Senator Gallego reminded Miran of the economic disaster that occurred during the 1970s when the Federal Reserve – led then by President Nixon’s former counselor Arthur Burns – caved to political pressure to lower interest rates.

“What happened to the economy and to the independence of the Federal Reserve under Richard Nixon while Mr. Burns was chairman of the Federal Reserve? … Would you say that what occurred in terms of the pressuring of the Federal Reserve by President Nixon to drop interest rates probably caused directly stagflation?” Senator Gallego asked.

“You understand why we’re concerned because we’ve seen this playbook, right?” he continued. “So, I don’t understand how you don’t see why many people are worried about the fact that you’re going to go into a temporary position, hold your other position within the White House, and we don’t feel like the Sword of Damocles is going to be hanging over your head if you don’t lower interest rates, right? I think it’s a very reasonable request that should you be nominated that you resign as [Council of Economic Advisors Chair] and should you want to come back later then you go back to the nomination process.”

“But the fact that this president who we know is willing to hold government officials hostage – we just saw what happened with the BLS director – is going to be able to hold that over your head and we are going to question whether or not you’re going to be making the right decisions for this country not for your personal career. I think that is something that is extremely dangerous to the bond market, dangerous to our economy, and could really lead us into a direction that could make some permanent damage to the reputation of the Federal Reserve.”